Bobby Shell

143 posts

All posts

Introducing Voltage credit: A revolving line of credit that moves at the speed of Lightning

The industry's first programmatic revolving line of credit built on Bitcoin payment rails, in USD or BTC.

The First Publicly Reported $1M Lightning Transaction, and It Took .47 Seconds

Lightning was boxed in early as a micropayments network. That was never the full story. Today, it's settling million-dollar transactions. It's time the world sees Lightning for what it actually is.

Voltage + BitGo: Lightning From Qualified Custody Is Now Enterprise-Ready

Voltage is excited to announce a major advancement for enterprise Bitcoin payments: BitGo has launched Lightning Network access directly from qualified custody; powered by Voltage’s automated Lightning infrastructure.

The Instant Payout Infrastructure iGaming Executives Are Overlooking

Lightning-powered instant payout infrastructure on Bitcoin's Lightning Network slashes iGaming churn up to 30% by enabling 24/7 settlements in seconds. Voltage provides enterprise SaaS with cloud-hosted nodes, APIs, and automated liquidity management. Operators cut fees to fractions of a cent, reduce support tickets, and boost retention. Gaming drove 27% of Lightning's 2023 transaction growth, delivering seamless revenue gains.

Reducing Fraud and Chargebacks in iGaming with Bitcoin Payments

Fraud and chargebacks cost iGaming operators over $2+ billion per year, largely due to reversible payment rails like ACH and credit cards. Bitcoin payments over the Lightning Network eliminate reversals, reduce fraud vectors, and enable instant, programmable payouts that protect margins and improve player experience.

The Bitcoin Payments Flywheel: How to Earn Self-Custody Yield on Idle Capital in iGaming and Exchanges

Voltage and Amboss have launched a new enterprise stack that leverages the Lightning Network to help high-volume businesses like iGaming and crypto exchanges turn payment processing from a costly expense into a self-custody revenue source by earning yield on idle Bitcoin.

The Rise of Crypto Sweepstakes: A Legal Path to Web3 Gaming

How compliant sweepstakes models are paving the way for blockchain-powered gaming

Sweepstakes 2.0: Bringing Instant Payouts to Social Casinos with Bitcoin

How the next generation of sweepstakes and social casino platforms are modernizing the player experience.

How Bitcoin and Stablecoins Will Transform Online Casino Liquidity

Exploring how Taproot Assets and Lightning enable instant, dollar-denominated gameplay and settlement, with near zero fees and zero chargebacks.

Voltage Joins the FSGA to Help Advance Real-Time Payments for the Future of Fantasy and iGaming

Voltage is proud to join the Fantasy Sports & Gaming Association (FSGA) to help usher in a new era of instant, global, chargeback-free payouts in real-money gaming. As platforms evolve, our Lightning-powered infrastructure empowers operators to deliver faster, fairer, and more trusted payment experiences.

The US iGaming Profit Unlock: The Court Just Freed You From the App Store Tax

The two-sentence summary, made punchy and concise: The US court injunction instantly frees iGaming operators from the 15-30% Google Play commission, creating a decade's worth of margin expansion. CEOs must urgently adopt Voltage's Lightning Network to replace high-cost fees with near-zero, zero-fraud, sub-second payments, turning lost revenue into decisive player loyalty and competitive advantage.

10 Reasons Why Instant Bitcoin Payments Are the Future of iGaming

How Lightning’s global payment infrastructure is solving latency, fraud, and cost challenges in online gaming

From Fiat Friction to Instant Play: How Bitcoin Lightning Is Transforming iGaming, Prediction Markets, and Redemptions

A player-first look at faster withdrawals, fewer chargebacks, and global access.

Beyond the Bottleneck: How Lightning and Stablecoins Will Outscale Ethereum for Global Payments

Breaking down why Bitcoin’s Lightning Network is the only crypto scaling solution that can scale stablecoins, enabling millions of instant, low-cost payments without the bottlenecks of Ethereum or Solana. It also explores how stablecoins—especially Tether launching on Lightning\, will unlock a new era of global payments, making digital dollars fast, cheap, and accessible worldwide.

Voltage Payments on Mainnet: Credit Backed Lightning Payments Are Live

Voltage Payments is now live on mainnet, and eliminates the need for businesses to pre-fund or manage their own Lightning Network liquidity by offering a credit-based model that enables instant Bitcoin transactions. Companies can now move money at internet speed, settling in USD or BTC later, freeing up capital, reducing operational overhead, and accelerating product launches through a simple API-driven payments platform.

Chipper Cash Now Processes Over 50% of Bitcoin Transactions Through Lightning — Powered by Voltage

Chipper Cash now processes over 50% of its Bitcoin transactions through the Lightning Network, powered by Voltage — a major leap forward in real-world Bitcoin payments. This milestone highlights how fintechs in emerging markets are leapfrogging legacy rails to deliver faster, more reliable, and lower-cost payments at scale.

Reimagining Wallet Architecture: How Segregated Wallets Can Power Neo-Bank Growth

The future of neo-bank growth is powered by per-user wallet infrastructure that supports both Bitcoin and stablecoins. Voltage Payments makes it possible to launch today and be ready for tomorrow’s high-demand, multi-asset customer experience without costly rebuilds.

Why the Future of Payment Rails Is Built on Bitcoin and Lightning, Not Legacy Systems

Legacy finance relies on a patchwork of message-based rails like ACH and SWIFT, resulting in multi-day delays, high fees and chargebacks. This system, designed decades ago, hasn’t caught up with the instantaneous nature of the internet.

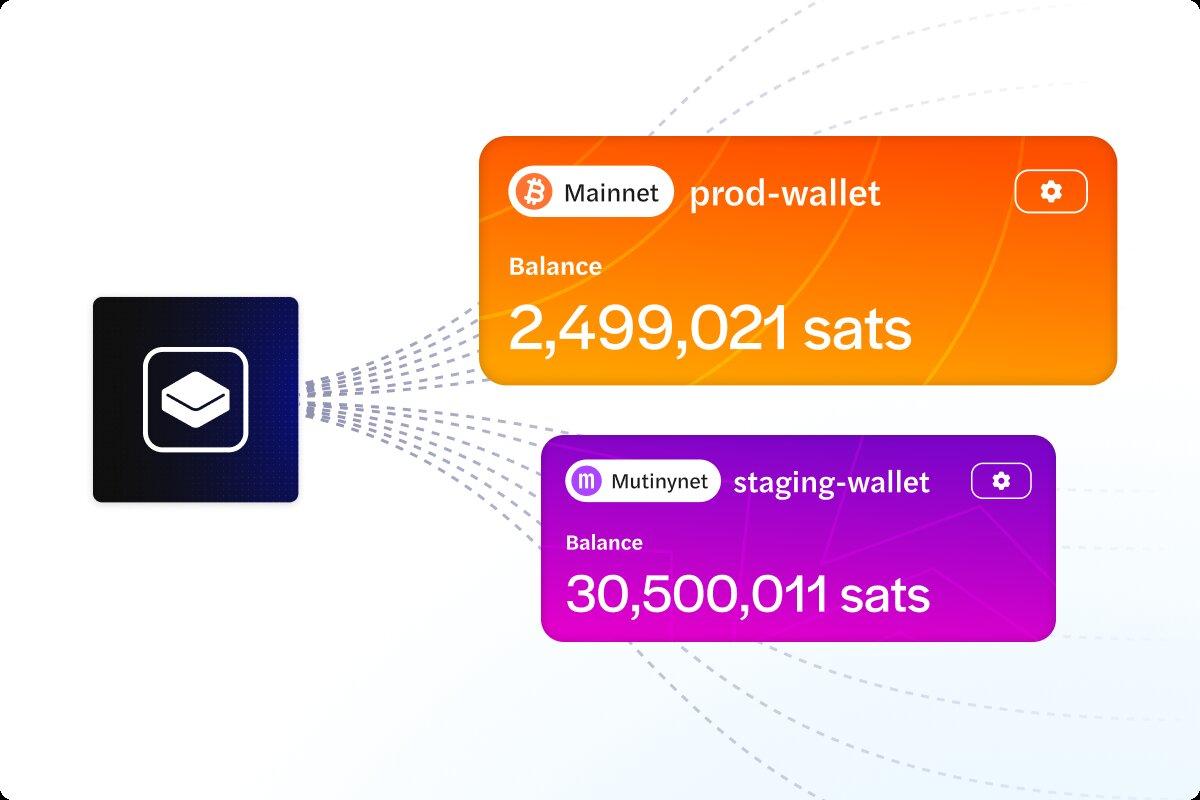

Introducing Node-Backed Wallets: The Best of Lightning Payments with Full Node Control

Today we launch Node-Backed Wallets, giving developers the power to run their own LND node while unlocking our full Payments platform — including clean APIs, wallet segregation, compliance tools, and real-time webhooks. Build faster, stay sovereign, and skip the complexity.

Voltage for iGaming: The Scalable Payment Infrastructure for Betting Platforms

iGaming is being held back by outdated payment rails—high fees, slow withdrawals, chargebacks, and global friction. This blog breaks down how Lightning and Voltage unlock instant, low-cost, borderless payments that give operators speed, compliance, and total control.

Real Data, Real ROI: 7 Reasons Executives are Betting on Lightning Network

Real-world data shows Lightning Network adoption is accelerating across major exchanges, wallets, and platforms—driving faster payments, lower fees, and deeper user engagement. This blog breaks down why now is the time to go Lightning and how to do it right.

Powering Instant Mining: Voltage Brings Lightning to the Blockware Marketplace

Voltage and Blockware have partnered to bring Lightning-native payments to the Blockware Marketplace, enabling instant miner purchases and real-time deployment. This integration marks a new era for Bitcoin mining infrastructure — one where capital converts into compute in seconds.

What PSPs Need to Know to Compete in a Real-Time World

Payment providers face mounting pressure to offer faster, cheaper, and more global solutions. This article explains why the Lightning Network is the key to unlocking real-time payments, lower fees, and a strategic edge — without the Bitcoin volatility.

ALT5 Sigma Launches Lightning Network Integration to Power Instant Bitcoin and Tether Payments in Partnership with Voltage

Support for Bitcoin and Stablecoins on Lightning Underscores ALT5’s Commitment to Scalable, Real-Time Settlement Infrastructure

The Real Cost of Ignoring Lightning: Why Top Exchanges Are Making the Shift

Forward-thinking product leaders and CFOs at crypto exchanges are turning to the Lightning Network to reduce fees, accelerate withdrawals, and unlock new revenue streams. As user expectations shift toward instant, low-cost payments, platforms that fail to integrate Lightning risk falling behind—while those that act now are gaining a powerful edge in speed, efficiency, and user experience.

Beyond SWIFT: Instant Global Settlement with Bitcoin Payments

SWIFT-based payments are too slow, expensive, and opaque for today’s real-time global economy. With the rise of the Lightning Network and stablecoins like Tether, platforms like Voltage Payments are enabling instant, low-cost, 24/7 settlement over Bitcoin rails—without sacrificing compliance, usability, or fiat integration.

New Voltage Platform enables fastest way to enable bitcoin and soon stablecoin transactions

Voltage Payments is a next-generation Lightning Network solution that lets businesses integrate instant, low-cost Bitcoin and stablecoin payments through a simple API—eliminating the need for nodes, liquidity management, or complex infrastructure. With flexible custody options, USD settlement, and built-in compliance, it modernizes payments by replacing outdated systems with real-time, global transaction capabilities.

Unocoin selected Voltage to Launch Bitcoin & Soon Tether Payments Over Lightning in India

India’s longest-standing crypto exchange, Unocoin, has partnered with Voltage to enable instant, low-cost Bitcoin and Tether payments through the Lightning Network, setting a new benchmark for digital asset transactions in the region.

BitGo and Voltage Team Up to Deliver Instant Bitcoin and Stablecoin Payments via Lightning

Voltage and BitGo are teaming up to bring instant, low-cost Bitcoin and stablecoin payments to institutions through the Lightning Network.

Amber App Partners with Voltage to Bring Lightning-Fast Bitcoin Payments to Australia

Voltage has partnered with Amber App to power lightning-fast, low-cost Bitcoin payments in Australia, enabling a seamless and scalable payment experience through the Lightning Network.

Do I Need a License to Accept Bitcoin Payments?

Bitcoin payments are catching on fast. More businesses are embracing it as a way to cut processing fees and open their doors to global customers. But there’s one big question that holds many back: Do I need a license to accept Bitcoin payments?

Is Accepting Bitcoin Legal for My Business?

The world of payments is changing fast, and Bitcoin is at the center of that shift. More businesses are exploring Bitcoin as a payment option, drawn by its low fees, borderless reach, and immunity to chargebacks.

Voltage and Taxbit Partner to Deliver the First Fully Compliant Lightning Payments Solution

Voltage and Taxbit have partnered to launch the first fully compliant Lightning payments solution, enabling businesses to adopt Bitcoin and stablecoins with seamless tax and accounting integration. This integration ensures real-time compliance, scalable treasury management, and audit-ready financials, aligning with the recent repeal of SAB 121.

Is Bitcoin Good for High-Risk Businesses?

In the world of business, some industries naturally operate on thinner ice. Whether it’s due to regulatory scrutiny, high chargeback rates, or shifting financial policies, certain businesses find themselves labeled as “high-risk” by traditional banks and payment processors.

Bitcoin, the Lightning Network, and the Future of Gambling: A Game-Changer for Casinos

Casinos are facing increasing fraud risks due to Bitcoin’s Replace by Fee (RBF) loophole, which allows players to reverse transactions after placing bets. Voltage’s Lightning-powered payments eliminate this risk with instant, irreversible deposits, reducing fraud, increasing player activity, and unlocking new revenue opportunities in the rapidly growing crypto gambling market.

Braiins Reaches 1,000 Daily Lightning Payouts With Voltage, Pioneering Instant Miner Payments

Braiins has reached a major milestone of processing over 1,000 daily Lightning Network payouts, revolutionizing Bitcoin mining payments with instant, low-cost transactions. This shift, driven by its partnership with Voltage, is setting a new industry standard for scalable and efficient miner payouts.

Netcoins CEO Fraser Matthews Joins Voltage as Strategic Advisor to Bridge Crypto and Traditional Finance

Voltage is excited to welcome Fraser Matthews as a Strategic Advisor to accelerate institutional adoption of Lightning payments, leveraging his extensive experience in digital banking, fintech, and crypto exchanges. With his guidance, Voltage will continue bridging the gap between traditional finance and Bitcoin’s Lightning Network, enabling businesses to integrate instant, low-cost Bitcoin transactions seamlessly.

Why Bitcoin Remains the Only Untarnished Crypto in the Eyes of Payments Providers

Bitcoin's resilience and unmatched decentralization make it the only untarnished digital asset for payments, standing strong against centralization risks and governance failures seen in other crypto networks. With the Lightning Network enabling fast, trustless transactions and stablecoin integration enhancing usability, Bitcoin remains the most secure and future-proof payment solution for businesses and payment providers.

Fixing Bitcoin Payments for Casinos: How Lightning Eliminates Fraud for Digital and In-Person Betting

Bitcoin’s Replace-by-Fee (RBF) feature creates a major fraud risk for both online and in-person gambling payments, allowing players to reverse transactions after placing bets. The Lightning Network eliminates this issue by enabling instant, irreversible payments, ensuring secure and cost-effective transactions for casinos and betting platforms.

The Next Big Wallet Feature? Why Stablecoins on Lightning Will Be a Game-Changer

The integration of stablecoins with the Lightning Network in 2025 will revolutionize digital wallets by offering instant, low-cost, and stable transactions. As a leading Lightning payments provider, Voltage empowers wallet developers with seamless infrastructure and strategic guidance to implement and scale stablecoin support effectively.

Unlocking Tether’s Potential on Lightning: Voltage’s Open, Interoperable API for Businesses

With Tether’s USDT launching on the Lightning Network, businesses now have a powerful way to enable instant, low-cost transactions. This blog explores why an open, interoperable infrastructure is critical for adoption—and how Voltage is providing the tools to make it happen.

Unbank Teams Up with Voltage to Bring Lightning-Fast Bitcoin Transactions to 40,000+ Locations, Including Walgreens and CVS

Unbank has partnered with Voltage to enable Lightning-powered Bitcoin transactions at over 40,000 locations, including Walgreens and CVS. This integration brings instant, low-cost Bitcoin payments to everyday users, making cryptocurrency more accessible and seamless.

Future-Proofing Financial Transactions: The Role of Instant Settlement in 2025

No existing financial system—traditional or crypto—delivers truly global, instant, and final settlement. Only Bitcoin, the Lightning Network, and stablecoins on Lightning offer a breakthrough solution, eliminating intermediaries, reducing costs, and ensuring unstoppable, irreversible transactions in 2025 and beyond.

The Next Frontier of Payments: How Stablecoins Create Hypergrowth of Revenue

Discover how stablecoins on the Lightning Network are transforming payments with lower fees, faster settlements, and global scalability. Learn how businesses can unlock hypergrowth by embracing this next-generation solution.

Voltage vs. Lightspark: Choosing the Right Partner for Lightning Payments

This blog compares Voltage and Lightspark, two leading Lightning Network service providers, to help businesses choose the right partner. Voltage stands out with its developer-friendly APIs, flexible pricing, and Bitcoin-native solutions, while Lightspark takes a newer, proprietary approach with centralized features and higher complexity. Voltage’s focus on scalability and innovation makes it the preferred choice for businesses prioritizing Bitcoin adoption.

Future-Proof Stablecoins: Why Bitcoin and Lightning Are Game-Changers

Discover why Bitcoin and the Lightning Network are poised to revolutionize stablecoins, offering unparalleled security, scalability, and cost-efficiency compared to existing platforms like Ethereum and Tron.

How to Track Bitcoin Transactions for Accounting

If you're working with Bitcoin, whether you're a solo dev, a finance lead, or managing a growing team, eventually someone will ask: “Where’s the transaction history for this?” Unlike traditional banking systems, Bitcoin doesn’t send you monthly statements or tidy CSVs. Tracking what came in, what went out, and what it was for isn’t just about peace of mind; it’s about clarity, compliance, and good operations.

How to Prevent Chargebacks With Bitcoin Payments

Chargebacks are the silent revenue killer that far too many businesses learn to live with, until they don’t. Whether it’s a digital product wrongly disputed as “unauthorized” or a refund request that morphs into a bank-initiated reversal, chargebacks create a vortex of lost revenue, admin headaches, and rising payment processor scrutiny.

Is Bitcoin Payment Processing Safe for Businesses?

Bitcoin has gone from a fringe experiment to something serious businesses are starting to consider. But every time a company asks, “Should we accept Bitcoin?” the real question underneath is, “Is Bitcoin payment processing safe for businesses?”

Introduction to Stablecoins in 2025

Stablecoins provide a stable bridge between traditional finance and digital assets, offering practical solutions for global transactions and everyday payments. This article explores the history, types, and use cases of stablecoins, along with the regulatory landscape shaping their future. With advancements on Bitcoin, stablecoins now have a more secure and efficient foundation, opening new possibilities for businesses and users alike.

Why Exchanges and Neobanks are choosing Voltage for Lightning over DIY

A deep dive comparison on the challenges and hurdles of running DIY Lightning compared to Voltages Lightning Payments Provider.

The Risks of Current Stablecoin Networks: Why Bitcoin and Lightning Offer a Safer Alternative

Examining the risks of Ethereum and Tron as stablecoin networks and why Bitcoin and the Lightning Network offer a safer and more efficient solution.

The Rise of Stablecoins: Global Demand and How Bitcoin and the Lightning Network Could Be the Future

Today I break down why Stablecoins on the Lightning Network solve most of Stablecoins issues today. Decentralized networks with an appropriate incentive structure and the only decentralized blockchain (Bitcoin) win.

Deprecating Flow 2.0 – Paving the Way for a Superior Solution

We believe we can push the boundaries even further. Our new platform, currently in development, promises to offer an even more efficient, user-friendly, and powerful solution for connecting to the Lightning Network.

How Do Refunds Work with Bitcoin Transactions?

Understanding how refunds work with Bitcoin transactions means acknowledging that we’re operating on a decentralized, irreversible ledger. Once a transaction is confirmed, there’s no “undo” button. For a customer, that means mistakes can be costly. For a company, that means refund policies aren’t just a line in your terms, they’re part of your infrastructure.

How Neobanks Harness Bitcoin and the Lightning Network for the Future of Finance

Bitcoin and the Lightning Network enable neobanks offer faster, more secure, and globally accessible financial services that align with the demands of today’s digital-savvy customers.

What Are the Tax Implications of Accepting Bitcoin?

Accepting Bitcoin might feel like stepping into a new frontier, but when it comes to taxes, it’s more like stepping into a minefield. For businesses, Bitcoin isn’t just a currency, it’s property in the eyes of the IRS. And that distinction comes with a set of reporting requirements and tax consequences that many overlook until it’s too late.

Understanding Voltage's Lightning Network API

Learn how to programmatically manage your node to create custom services and applications that want to interact with the Lightning Network.

Driving Successful Digital Transformation with Voltage's Bitcoin Platform

Learn how the Voltage Bitcoin Platform reduces friction, costs and improves go-to-market execution for Enterprises

Voltage Enhances Bitcoin Development with Mutinynet Integration

Introduction to Runes: Fungible Tokens On Bitcoin

Solving API Monetization Challenges with the Lightning Network

Voltage releases Redesign, Teams, and Pricing Updates to enable Bitcoin Builders

What the Bitcoin ETF Means for Bitcoin Adoption

Picnic Group leverages Voltage lightning payments to create deeper community ties

What Crypto is associated to AI?

Flow 1.0 Phase Out Announcement

ChangeLog 09/2023

Understanding Hold Invoices on the Lightning Network

Voltage Achieves SOC 2 Type II Compliance: Elevating Our Commitment to Security and Trust

Voltage has achieved SOC 2 Type II compliance, demonstrating its commitment to data security and operational excellence. This milestone assures business leaders of Voltage's robust security measures, continuous improvement, and dedication to protecting client data.

The Essential Guide to Nostr Relays: From Understanding to Implementation

Understanding NOSTR: Data Storage, Relays, and Decentralization

Mastodon vs. Nostr: Unpacking the Open Source Social Protocols

Understanding Inbound Liquidity in the Lightning Network: Simplified

Announcing Voltage x Human Rights Foundation Partnership

Nostr’s Relationship with Bitcoin

The Growth of Nostr: The Era of Decentralization

Exploring 6 Use Cases of Nostr Protocol

Nostr: The Decentralized, Censorship-Resistant Messaging Protocol

Surge now available for Voltage users

Voltage scales Bitcoin and Lightning Network infrastructure with Google Cloud

Exploring the Benefits of Lightning Network for Enterprises

Announcing Nostr support on Voltage with NIP05, Lightning Address, and Zaps

Blockware Solutions uses Voltage for Secondary ASIC Market

Solving $1 trillion dollar unpaid invoice problem

Why Exchanges Need Bitcoin Lightning Network Deposits and Withdrawals

What is Lightning Network Capacity

How many transactions can the lightning network handle?

How to start a Bitcoin-Focused Business

TRUBIT bringing Digital Loyalty Assets to Bitcoin

In Browser Bitcoin Payments w/ Moritz Kaminski of Alby

Running a successful Bitcoin business w/ Scott Sibley of SHAmory

FOSS Fridays #10

Running Business on Bitcoin and Lightning

Effortless Inbound Channel Opening for Voltage Nodes

Austin Bitcoin Design Club Interview

Direct audience funding and remonetizing the web w/ the Mash team

Bitcoin and Lightning Network Impact on Music w/ Michael Rhee, Founder of Wavlake

Lightning Network and Nation-State Adoption with Samson Mow

Copywritten Music Will Love the Lightning Network

Bitcoin's Future - Discussion with Stacy Herbert and Max Keiser

How the Lightning Network potentially solves fake reviews

Bitcoin Banking with Brianna and NOAH Team

Discussing Bitcoin and Lightning Network with Jeff Booth

Small Businesses Embracing Bitcoin w/ Oshi App Co-Founder Michael Atwood

Announcing Voltage Startup Program

Lightning Advancements with Lyle Pratt, Founder of VIDA

How Voltage Expedites Value 4 Value Monetization

BTCPay Server x Voltage: Become a Bitcoin Merchant

Announcing Surge and our Next Generation platform

The next phase of the Voltage brand

#SATSx Hackathon - Sponsored by Voltage

Visa, Mastercard raise fees, Lightning Network keeps fees low

How to start Bitcoin Crowdfunding

Voltage Announces $6 Million Seed Round led by Trammell Venture Partners, with Craft, GV, and Additional Investors

Sovereignty: Cold Storage & Your First Lightning Node

Lightning Node Observability w/ @BitcoinCoderBob

How to Accept Bitcoin and Lightning Network Payments

How many Lightning nodes are there?

BIPs and BOLTs

Flow Dashboard Now Available

Bitwage x Voltage - First salary payments on Lightning

Lightning Infrastructure - API’s used to build Lightning Apps “LApps”

Amazon Customers Blocked from Using Visa. Hello Lightning!

LApps & Forecasting Advancements On Bitcoin & Lightning

Panels with Voltage @ TabConf 2021

What is the best Lighting Wallet for you?

Are Lightning Nodes Profitable?

Why Businesses Should Run Their Own Node

Introducing Flow: Effortlessly Create Lightning Channels

What does it mean to run your own node?

How to start using the Lightning Network

Decentralize everything with Lightning Nodes

How to accept Bitcoin Payments on Shopify

$1 Lightning Nodes for Uptober

What is a Bitcoin Node?

What is the Lightning Network?

Voltage Provides Free Nodes at ShellHacks, Florida’s Largest Hackathon

How the Lightning Network is Innovating Podcasting

The Bitcoin Lightning Networks Impact on the Future of Payments

Accepting Bitcoin Payments on Your Website

Impervious Hack for Freedom 2021 - Rundown