Why the Future of Payment Rails Is Built on Bitcoin and Lightning, Not Legacy Systems

Legacy finance relies on a patchwork of message-based rails like ACH and SWIFT, resulting in multi-day delays, high fees and chargebacks. This system, designed decades ago, hasn’t caught up with the instantaneous nature of the internet.

The Cracks in the System: Why Legacy Payments Are Failing the Internet Age

You don’t notice it until you do. The wait. The fees. The failed settlements. In an internet-connected world where data moves at light speed, money still crawls.

- The Delay: ACH and wire transfers often take 3–5 business days. SWIFT can take longer, especially across borders.

- The Cost: Credit card processing fees hover around 2.9% per transaction. International payments tack on FX spreads and intermediary bank fees.

- The Risk: Finality doesn’t exist in traditional payments. Chargebacks create uncertainty and shift power away from the merchant.

These are not bugs — they are deeply embedded features of a legacy system designed for a different era.

Castles on Sand: The Outdated Architecture of Legacy Finance

Today’s financial system runs on a patchwork of message-passing protocols like ACH, SWIFT, and Fedwire — systems designed before the internet was even mainstream.

- Transactions are not money, just messages requesting money.

- Final settlement often happens hours or days later.

- Each hop — each intermediary — adds cost, time, and risk.

Meanwhile, the internet revolutionized communication and data exchange. But money? It's still waiting for its protocol moment.

The Foundation: Bitcoin as the Global Settlement Layer

Bitcoin is more than a financial asset — it’s infrastructure. For the first time ever, we have:

- A Native Bearer Asset: Bitcoin is not an IOU. Ownership is cryptographic, not custodial.

- Final Settlement: When a Bitcoin transaction confirms, it's done. Irreversible.

- Permissionless & Global: Bitcoin doesn’t know geography. It works anywhere, anytime, with anyone.

Bitcoin gives us a neutral, incorruptible layer for global value transfer — and it’s already being used this way by institutions like Cash App, whose Lightning node generated a 9.7% yield on deployed capital in 2025.

The Speed Layer: Scaling Payments with the Lightning Network

If Bitcoin is the settlement layer, Lightning is the real-time payment rail.

- Speed: Lightning settles in milliseconds, not minutes or days.

- Cost: Fees are fractions of a cent, enabling micropayments and streaming money.

- Privacy: Transactions aren’t broadcast to the entire network.

It’s the payment layer the internet never had. With over 122 million Lightning-capable wallets live today and integrations by Kraken, Cash App, Binance, and Coinbase, the infrastructure is no longer hypothetical — it’s operational.

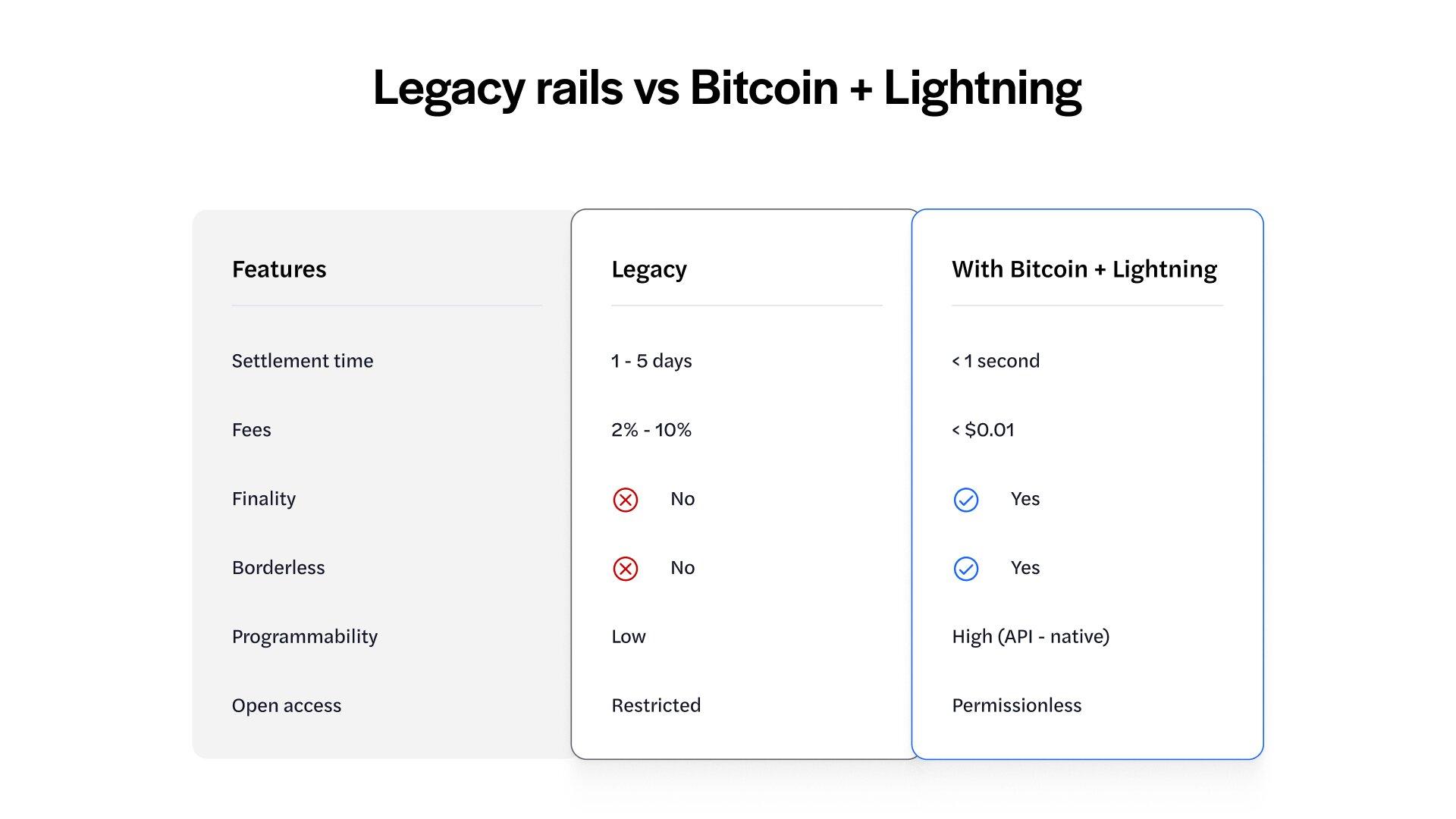

A Head-to-Head Comparison: Legacy Rails vs. Bitcoin + Lightning

## From Theory to Practice / How Voltage Powers the New Payment Era Building on Lightning doesn't require reinventing the wheel. With Voltage, businesses get two clear paths:

- Voltage Nodes: For teams that want full control and customization with open-source compatibility.

- Voltage Payments API: For businesses that want a turnkey Lightning integration with a simple API and no node management.

You focus on your product — we handle the infrastructure.

The Future Isn’t Coming. It’s Already Here

We’re no longer speculating. Lightning is real, and it's scaling:

- Billions of dollars in implied annual volume.

- Yield-bearing nodes operating in production. (Learn how public companies are earning yield with lightning network)

- Taproot Assets bringing dollar stablecoins to Bitcoin.

- AI agents making API calls and paying via Lightning (L402).

Like email in the 1990s or mobile apps in the 2010s, this is the new protocol layer for a digitally native economy. Businesses that adopt today will define and dominate tomorrow’s financial landscape.

**Don’t wait for the future of payments. Build it with Voltage. Get a strategy session and learn how to Go-To-Market with Success.**