Several concepts warrant further explanation as the Lightning Network continues to revolutionize the Bitcoin blockchain’s scalability issues. Today, we’ll unpack one such vital concept – inbound liquidity – and how it interacts with outbound liquidity and channel rebalancing to ensure the efficient operation of Lightning Network channels.

What is Inbound Liquidity in Lightning Network?

Inbound liquidity refers to the amount of Bitcoin others on the Lightning Network have committed to channels with your node. These are the funds that others have locked up in channels connected to you, enabling you to receive payments.

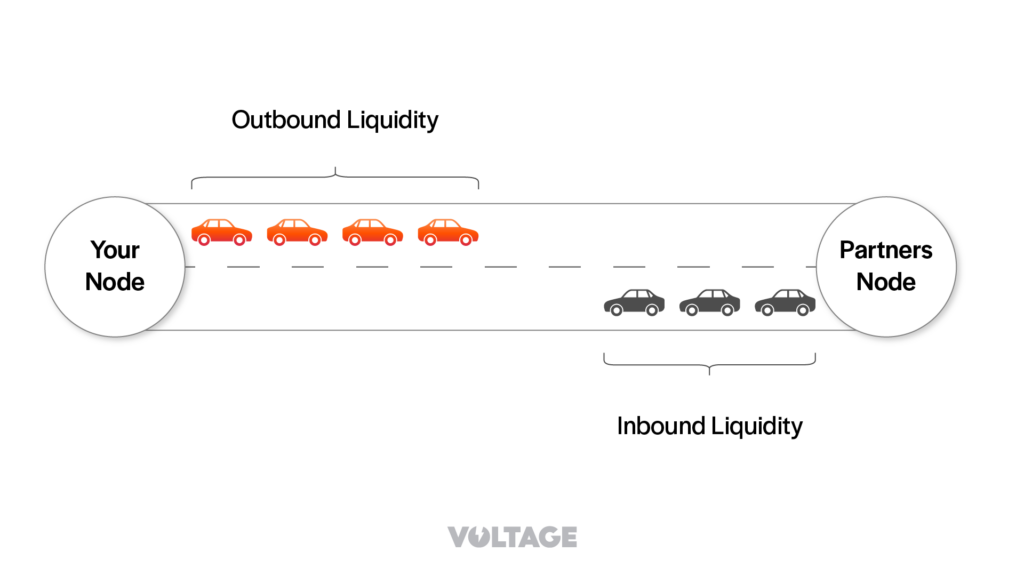

Think of Lightning Network channels as two-lane highways, with cars (Bitcoin transactions) moving in both directions. Inbound liquidity is like the capacity of one lane, determining how many cars (transactions) you can receive.

How do You Get Inbound Lightning Liquidity?

Getting inbound liquidity can be achieved in several ways. You can request others to open channels with you, or use a service that provides inbound liquidity, like Voltage’s Flow. You can also spend some of your outbound liquidity, which we’ll explore next.

Remember, the more inbound liquidity you have, the more likely you can receive a payment successfully assuming you have quality peers.

What is Outbound Liquidity?

On the other side of the coin is outbound liquidity – the amount of Bitcoin you have committed to channels with others. It’s the capacity of the other lane of our highway analogy, representing your ability to send Bitcoin transactions.

You provide outbound liquidity when you open a Lightning Network channel and commit funds to it. If you have 0.1 BTC committed to a channel, you have 0.1 BTC of outbound liquidity, meaning you can send up to 0.1 BTC to your channel partner.

Channel Rebalancing of Inbound and Outbound Liquidity

Ideally, Lightning Network channels should maintain a balance of inbound and outbound liquidity. But as transactions occur, imbalances can arise. For instance, if you keep receiving payments, you’ll have increased outbound liquidity at the expense of your inbound liquidity. Similarly, if you only send payments, you’ll have higher inbound liquidity and depleted outbound liquidity.

This is where channel rebalancing comes into play, enabling you to shift liquidity from one channel to another. You can ensure your channels maintain sufficient inbound and outbound liquidity by redistributing your funds. This adjustment allows channels to operate more efficiently and keep the network flowing smoothly.

One popular rebalancing method is ‘circular rebalancing.’ This process involves making a circular payment to yourself, moving funds from a channel with excess outbound liquidity (channel A) to one lacking in outbound liquidity (channel B). This rebalances both channels: increasing channel A’s inbound liquidity and channel B’s outbound liquidity. (Example below)

Ensuring Efficient Channel Operation

For node runners, understanding and managing liquidity is essential. Inbound capacity ensures you can receive fees for routing payments and receiving transactions. With adequate inbound liquidity, you can capitalize on the Lightning Network’s potential, whether an individual or a business.

One of the most important aspects is keeping your inbound capacity efficient. By periodically rebalancing your channels, you can ensure that your node continues to send and receive payments efficiently. In the rapidly evolving world of the Lightning Network, being proactive about your liquidity management is key to staying in the fast lane.

To sum it up, inbound and outbound liquidity are two sides of the same Lightning Network coin, and both are vital for the network’s efficient operation. As the Lightning Network continues to mature and grow, expect to see more tools and services designed to simplify liquidity management, making participating even easier.

Read More

- Understanding Channel Rebalances

- Where does the Yield Come From?

- What are Negative Fees and How they Affect the Lightning Network?

You can spin up a lightning node and explore our lightning service provider and liquidity tool Flow today.

If you run LND and want to get the greatest time series for your nodes, check out Surge.