Where Does the Yield Come From?

LorenzoYield is a measure of the profit that an investor can expect to receive from a particular investment. In the context of the lightning network, “yield” refers to the interest earned on funds deposited in lightning channels. Unlike traditional finance investments, no counterparty risk is involved when generating yield in the lightning network because you don’t need to give custody of your money to a third party. Bitcoins locked in your node’s channel are still under your control.

There are different methods for generating yield on the lightning network. All these methods involve providing a valuable service to other participants, so they are willing to pay for it. In this post, we’ll explore what are those valuable services so we can understand where the yield comes from.

Routing Nodes

When you make a payment to a node you’re not directly connected with; your node has to find a path of connected nodes with enough liquidity to route the payment. If there is no path or not enough liquidity in the paths found, then the payment can’t be made. To incentivize participants to open channels to one another and, therefore increase the network’s efficiency, the lightning network enables nodes to charge fees to route payments.

Every node in the network can charge two types of fees when routing a payment: a base fee, which is a flat rate charged per payment routed, and a percentage fee, which is directly proportional to the size of the payment, meaning that the bigger the payment, the bigger the fee.

This means that you can specialize in routing payments through the network and earn yield by doing it. The value provided here enables payments routed through the network, increasing the payment success rate.

But this doesn’t mean that you need to open channels to some peers and, voila, you will start to generate yield. Running a profitable routing node it’s a difficult and active task. Many variables are involved: on-chain and off-chain fees, capacity, node uptime, and so on. The learning curve to understand how each one of those variables affects profitability is steep.

Also, the network is changing over time. New nodes are joining, others are leaving, and channels are constantly opening and closing. This means that the demand for routing payments is also changing. An efficient routing node has to spend time analyzing the network and managing the node to adapt to those changes.

For example, a route that connects Kraken to Loop can be a lucrative one, as Kraken is an exchange that has support to deposit and withdraw using lightning it should have a high demand for swapping on-chain bitcoin for lightning bitcoin and vice versa. On the other hand, a route between Fold and Kraken might not be lucrative because usually, people don’t pay merchants from exchanges.

Finally, as payments are routed through the node, its liquidity will become unbalanced. The node runner will have to find ways of rebalancing its channels. Currently, the most popular method of rebalancing channels is through a technique called “circular rebalancing”. There are ways of automating circular rebalances, but they do cost money. So, even though this issue can be fixed passively, these costs should be considered when calculating profitability.

If you want huge yields without hard work, routing payments is not for you. But if you’re willing to do the necessary work and become part of this emerging ecosystem, you can start by reading our guide on building a lightning network node for routing.

Renting Inbound Liquidity

In the early days of the lightning network, the only way of acquiring inbound liquidity was by having other nodes open channels with your node. It wasn’t trivial for participants to get access to inbound liquidity. Usually, peers choose well-connected and established nodes to open channels to. There was almost no incentive to open a channel with a new node. Acquiring inbound liquidity was a slow process, commonly involving talking to people directly over telegram or Twitter.

As discussed in this post, inbound liquidity enables peers on the lightning network to receive payments. This is extra special for merchants. No inbound liquidity means customers can’t use lightning to pay the merchant.

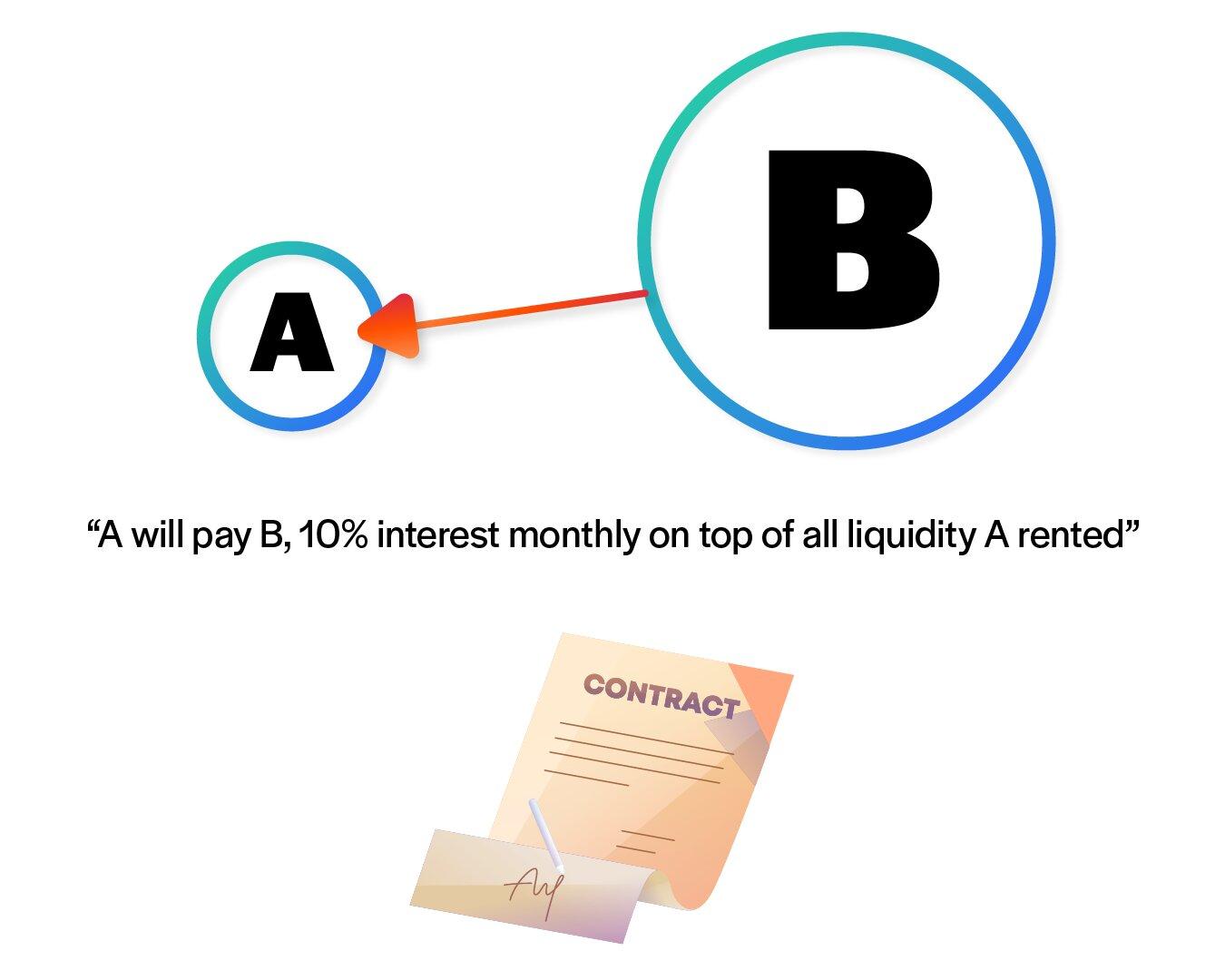

But what if there was a way of renting inbound liquidity? A merchant could pay interest to rent liquidity from a node with money “sitting around”. It’s a win-win scenario: the merchant can bootstrap its node quickly and start accepting Bitcoin over lightning as a payment method, and the seller can make his money work for him. This incentive structure gave birth to lightning’s liquidity marketplaces. A liquidity marketplace is an application that enables sellers to advertise their satoshis and buyers to rent the advertised liquidity.

In this case, the yield comes from the agreed-upon interest rate between the buyer and seller. When compared to routing payments, renting liquidity is a more passive activity, but it doesn’t come for free. Buyers are interested in renting inbound liquidity from reliable nodes with a good reputation. If your node goes offline too often, getting anyone to rent inbound liquidity from you won't be easy.

Liquidity marketplaces come in different shapes and forms. Let’s see some of the tools available in the ecosystem.

Lightning Pools

Lightning Pools is a tool built by Lightning Labs. It’s a non-custodial channel lease marketplace driven by auctions. Users maintain a 2-of-2 multisignature with the auctioneer and send bids off-chain, so bidders can’t see offers from other participants. The auctioneer executes completed orders in batches, reducing on-chain fees.

Voltage’s Flow is an integration built on top of Lightning Pools, where you can easily acquire inbound liquidity from the highest-tier nodes on the network. It has some advantages over using Pool directly. You don’t need to create and configure a pool account, you can use our UTXOs instead of yours, increasing your privacy.

Liquidity Ads

Liquidity Ads are currently only supported by CLN. It uses dual-funded channels, where both sides provide liquidity and the lightning network’s gossip protocol to advertise available liquidity.

Magma

Magma is a popular tool built by Amboss. It uses "HODL" invoices to create smart contracts that enable channel sellers to receive lightning payments only if they open the agreed-upon channel within a short period. This allows Magma to facilitate transactions without taking custody of user funds.

Concluding

In the Lightning Network, the yield comes from providing useful services to other participants in.

Routing nodes earn yield by charging fees for every payment they route. Routing payments efficiently enough to become profitable is a difficult job. It involves a plethora of variables, research, and active node management.

To be able to receive payments in the lightning network, you’re going to need inbound liquidity. This requirement created a market for renting liquidity. In this case, the yield comes from the interest rate charged on top of the rented liquidity. This is a more passive activity than running a routing node, but the yield doesn’t come for free: nodes that rent liquidity must be reliable.

Start building on Voltage today!